Want to share your content on R-bloggers? click here if you have a blog, or here if you don’t.

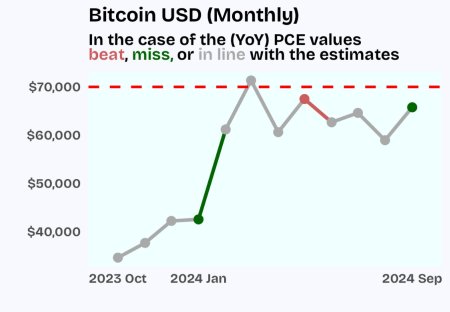

Could the latest PCE data catalyze Bitcoin to surge beyond major resistance and reach $70K? The last time that US PCE Price Index values were under the estimates (miss), BTC prices rocketed.

Source code:

library(tidyverse)

library(tidyquant)

library(timetk)

#U.S. PCE Price Index YoY

df_pce_yoy <-

read.delim("https://raw.githubusercontent.com/mesdi/investingcom/refs/heads/main/us_pce_yoy.txt") %>%

as_tibble() %>%

janitor::clean_names() %>%

rename(date = release_date) %>%

#removing parentheses and the text within

mutate(date = case_when(str_detect(date," (.*)") ~ str_remove(date," (.*)"),

TRUE ~ date)) %>%

mutate(date = parse_date(date, "%b %d, %Y"),

actual = str_remove(actual, "%") %>% as.numeric(),

forecast = str_remove(forecast, "%") %>% as.numeric()) %>%

mutate(date = floor_date(date, "month") %m+% months(1),

type = case_when(

actual > forecast ~ "Beat",

actual < forecast ~ "Miss",

actual == forecast ~ "In Line"

)) %>%

select(date, type) %>%

drop_na()

#Bitcoin USD (BTC-USD)

df_bitcoin <-

tq_get("BTC-USD") %>%

tq_transmute(select = "close",

mutate_fun = to.monthly,

col_rename = "btc") %>%

mutate(date = as.Date(date))

#Merging the datasets

df_merged <-

df_pce_yoy %>%

left_join(df_bitcoin) %>%

drop_na()

#Plot

df_merged %>%

ggplot(aes(date,

btc,

color = type)) +

geom_line(aes(group = 1), size =2) +

geom_point(size = 5) +

geom_hline(yintercept = 70000,

size = 1.5,

color = "red",

linetype = "dashed") +

scale_x_date(expand = expansion(mult = c(.1, .1)),

labels = scales::label_date("%Y %b"),

breaks = c(make_date(2023,10,1),

make_date(2024,1,1),

make_date(2024,9,1))) +

scale_y_continuous(labels = scales::label_dollar()) +

scale_color_manual(values = c("In Line" = "darkgrey",

"Beat" = "indianred",

"Miss" = "darkgreen")) +

labs(x= "",

y ="",

color = "Core PCE Estimates",

title = "Bitcoin USD (Monthly)",

subtitle = "In the case of the (YoY) PCE values <span style = 'color:indianred;'><br>beat</span>, <span style = 'color:darkgreen;'>miss,</span> or <span style = 'color:darkgrey;'>in line</span> with the estimates") +

theme_minimal(base_size = 20,

base_family = "Bricolage Grotesque") +

theme(panel.grid = element_blank(),

legend.position = "none",

plot.title = element_text(face = "bold"),

plot.subtitle = ggtext::element_markdown(face = "bold"),

axis.text = element_text(face = "bold"),

plot.background = element_rect(fill = "ghostwhite",

color = "ghostwhite"),

panel.background = element_rect(fill = "azure",

color = "azure"))

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you’re looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don’t.

Continue reading: Exploratory Data Analysis: Will PCE Data Push Bitcoin?

Long-Term Implications and Future Developments

In the article, the author explores the potential impact of the U.S. PCE Price Index data on the price of Bitcoin, illuminating a possible relationship between macroeconomic indicators and the cryptocurrency’s value. The code provided is used to merge data from the U.S. PCE Price Index and Bitcoin’s price, plotting the results to reveal potential trends. The crucial takeaway is the link between instances where the U.S. PCE Price Index values fell short of estimates and subsequent upswings in Bitcoin’s price.

Macroeconomic Indicators and Cryptocurrency

An implication of this finding is the potential influence of macroeconomic indicators on the price of cryptocurrencies like Bitcoin. Therefore, investors and market watchers looking to predict future trends in Bitcoin’s price could start considering macroeconomic data like the PCE Price Index as a part of their toolkit. Especially during times of uncertainty, digital assets like Bitcoin might function as alternative stores of value, even responding to economic indictors that have typically influenced more traditional forms of investment and securities.

Increased Interest in Research and Analytics

This potential relationship showcases the growing need for advanced research and analytics in the vast and often volatile field of cryptocurrencies. As digital assets become an increasingly integral part of the financial market landscape, using technology and data analytics to understand these connections could be the key to profitable investments. It could also spur further interest and development in data science modules and algorithms specific to cryptocurrency market movements.

Actionable Advice

Investors

- Incorporate Macroeconomic Indicators: Consider incorporating a broad range of economic data points into your analytical framework. The PCE Price Index may be a start, but additional indicators could also yield valuable insights.

- Foster Technological Skills: The use of the R Programming Language in the provided code highlights the increasing relevance of programming skills for investment analysis, particularly in novel arenas like cryptocurrency. Therefore, investing time and resources to learn these skills or to hire professionals with this expertise could yield significant rewards.

Data Scientists

- Digital Currency Research: Given the demonstrated potential for digital currencies to be influenced by economic metrics, consider focusing research efforts in this direction.

- Refine Models: Use these insights to refine predictive models for cryptocurrency, taking into account a wider range of indicators. Building more accurate and comprehensive predictive models could be key in staying ahead in this increasingly competitive market.